OVERVIEW

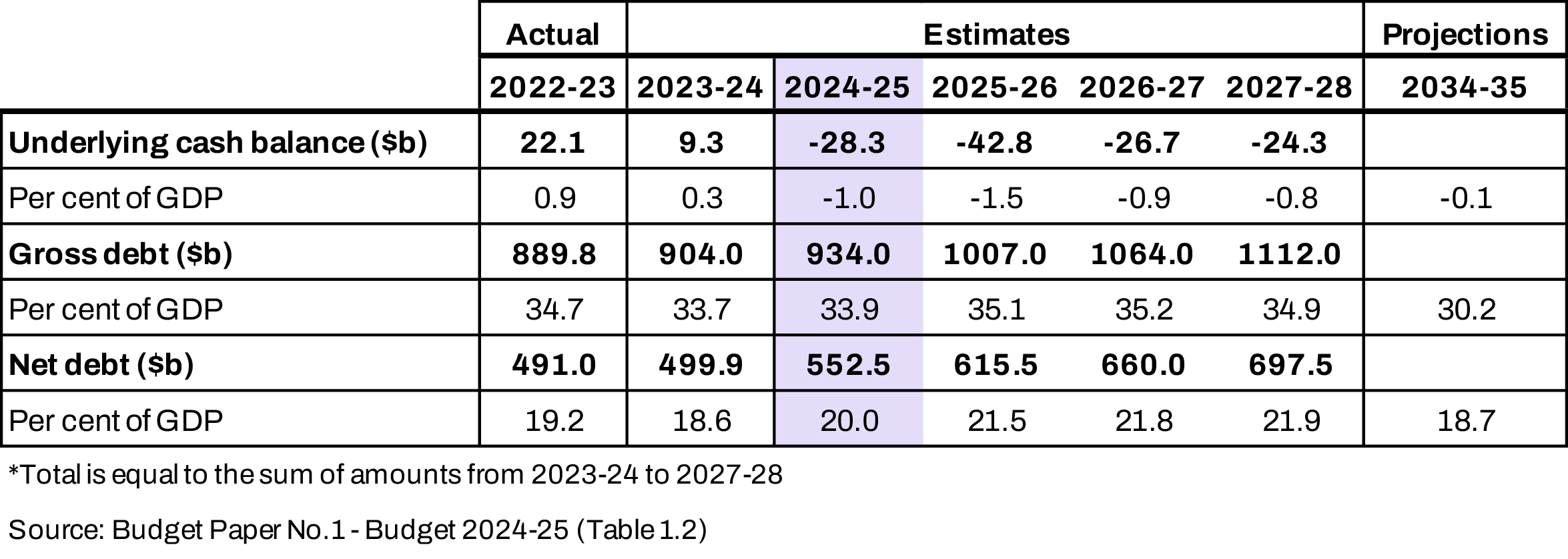

The Federal Budget for 2024-25, the third handed down by Treasurer Jim Chalmers, delivered a back-to-back surplus for the first time in nearly 20 years built on high commodity prices and strong employment.

Key features of this Budget include modified stage 3 tax cuts, targeted cost-of-living relief, an extension to the instant asset write-off for small business and substantial industry incentives.

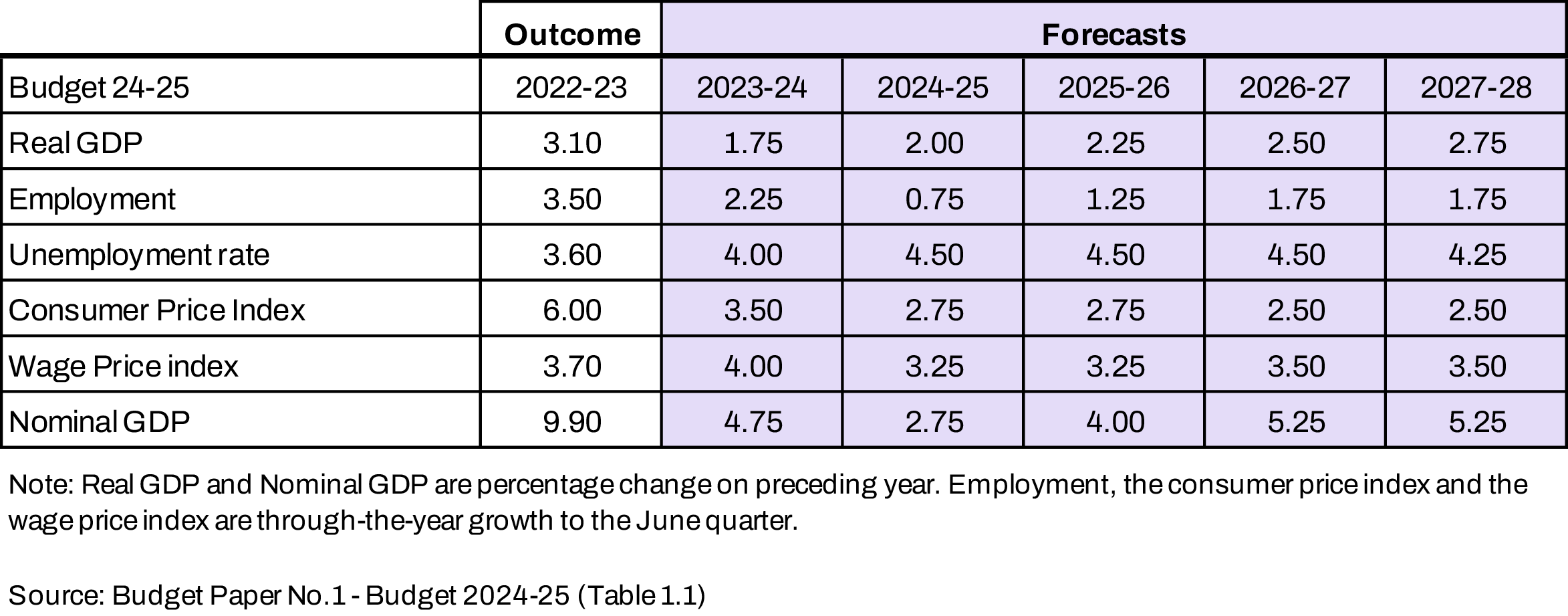

The Budget provides forecast of a challenging 2024-25 with economic growth remaining modest and unemployment continuing to rise. However, the Government expects its targeted cost-of-living relief measures to bring inflation back within the Reserve Bank of Australia’s target range in 2024-25.

Key measures

Future made in Australia: a $22.7 billion industry package offering tax incentives, subsidies and grants to bolster the economy as it shifts towards a clean-energy future. This includes a $1.7 billion innovation fund that could benefit SMEs and startups. NSW benefits from a share in the $1 billion investment for solar panel subsidies.

Stage 3 tax cuts: From 1 July 2024, 13.6 million taxpayers will receive tax cuts. The average benefit will be $1,888 per year, or $36 per week.

Energy bill relief: $325 for eligible small businesses and $300 for every household from 1 July 2024.

Housing: $11.3 billion towards building new homes. This includes $1 billion for roads, sewers, energy, water and community infrastructure, a doubling of Commonwealth homelessness funding to $400 million every year (matched by states and territories) and $9.3 billion for a 5-year National Agreement on Social Housing and Homelessness.

Instant asset write-off: instant asset write-off to be extended until 30 June 2025, allowing businesses with turnover under $10 million to deduct the cost of eligible assets under $20,000.

Supporting small business: $10.8 million over two years to extend the Small Business Debt Helpline and the NewAccess for Small Business Owners program.

Apprenticeships: Employers taking on apprentices in priority areas will be eligible for an additional $1,000 ($5,000 in total) to help subsidise costs associated with employing an apprentice. Individual apprentices training in priority areas will be eligible for an additional $2,000 ($5,000 in total) to assist them to undertake and complete their training.

Students: $89 million for 20,000 more fee-free TAFE and VET places for tradie trainees.