Business NSW backs push to revive Business Connect

September 2025

Read MoreNSW’s peak business body has renewed its calls for the Commonwealth and State Governments to collaborate on tax reform initiatives through the Council of Federal Financial Relations (the CFFR).

The call comes as part of Business NSW's comprehensive pre-Budget submission for the 2024/25 Federal Budget, amid a renewed debate about whether national GST redistribution is fair.

"The time has come for meaningful tax reform that can better distribute tax burdens on businesses and stimulate new economic growth," Business NSW CEO Daniel Hunter said.

“NSW’s raw deal at the hands of the Federal Government’s GST policy has again highlighted how important tax reform is in reigniting growth for small and medium enterprises (SMEs).

"We recommend that the Federal Treasurer focusses on working with the CFFR to reform Payroll Tax, GST, and income tax to create a better environment for dynamism and growth in Australia.”

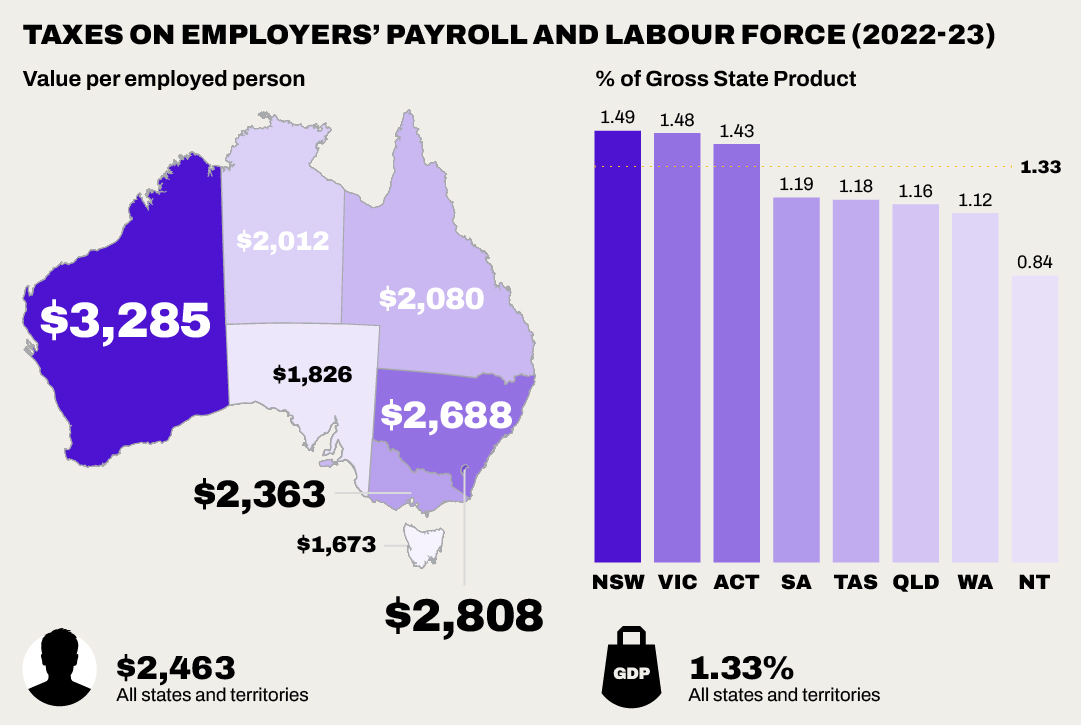

Business NSW analysis of Australian Bureau of Statistics data reveals the value of taxes on payroll paid by NSW businesses was $2688 per staff member, which was above the national average of $2463. NSW was the third most expensive by this measure, behind only WA ($3285) and ACT ($2808).

“The tax regime on SMEs, as it stands, is a handbrake on our national growth engine, but the stars are now aligned for brave reform,” Mr Hunter said.

The pre-Budget submission also includes a series of recommendations aimed at fostering a supportive business climate and addressing key challenges faced by SMEs.

Key recommendations are:

Tax Reform: Calling for a standing agenda of tax reform through the CFFR, including considerations for structured reductions in payroll tax, transitioning from stamp duties to broad-based land tax, and reshaping GST rates to reduce income tax.

Support for SMEs: Recommends reintroducing the instant asset write-off, positively supporting startups and SMEs by easing regulatory burden, and lessening the business cost impacts of compliance with the Privacy Act.

Housing: Highlights the need for further housing investment initiatives to assist in the million-house deficit.

Energy and Innovation: Calls for energy advice and support programs for SMEs as they move towards energy-efficient solutions, and urgent policies to rebuild confidence in the National Energy Market. Recommends supporting innovation in education and training models while addressing net-zero barriers for SMEs.

"We continue to emphasise the challenges faced by businesses post-COVID, including rising energy costs, insurance challenges and productivity concerns," Mr Hunter said.

"Our submission underscores the need for a growth agenda, urgently lowered energy bills, investment in innovation, and a coordinated state-federal productivity strategy to strengthen our economies and communities."

Business NSW's submission draws from insights gathered through surveys, including the flagship Business Conditions Survey.

"These recommendations are vital to creating a conducive environment for businesses to thrive, especially in the current economic climate," Mr Hunter said.